Ebitda Template - Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is short for earnings before interest taxes and depreciation. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability.

Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is short for earnings before interest taxes and depreciation.

Ebitda is widely used when assessing the performance of a company. Ebitda is short for earnings before interest taxes and depreciation. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is useful to assess the underlying profitability of the operating.

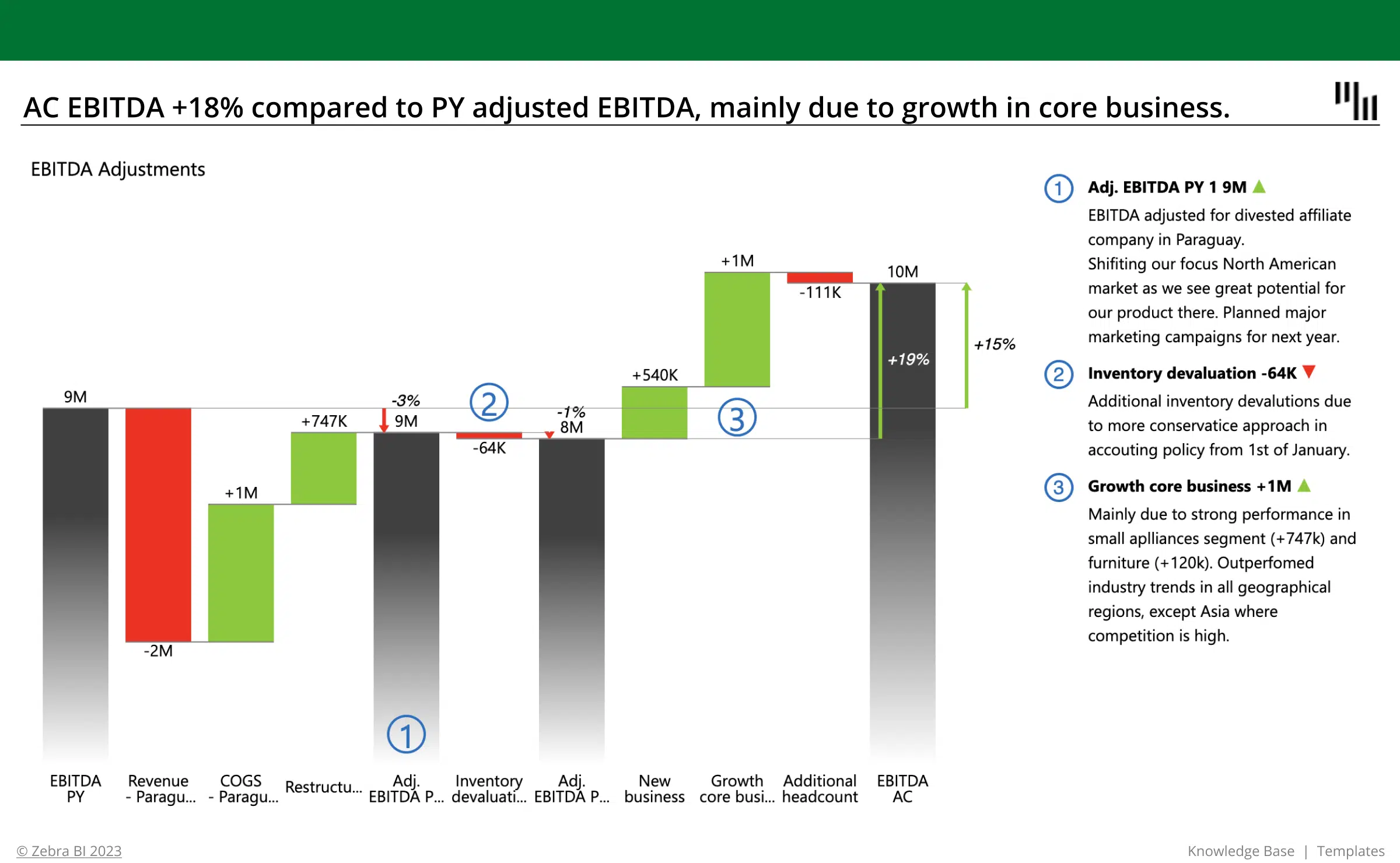

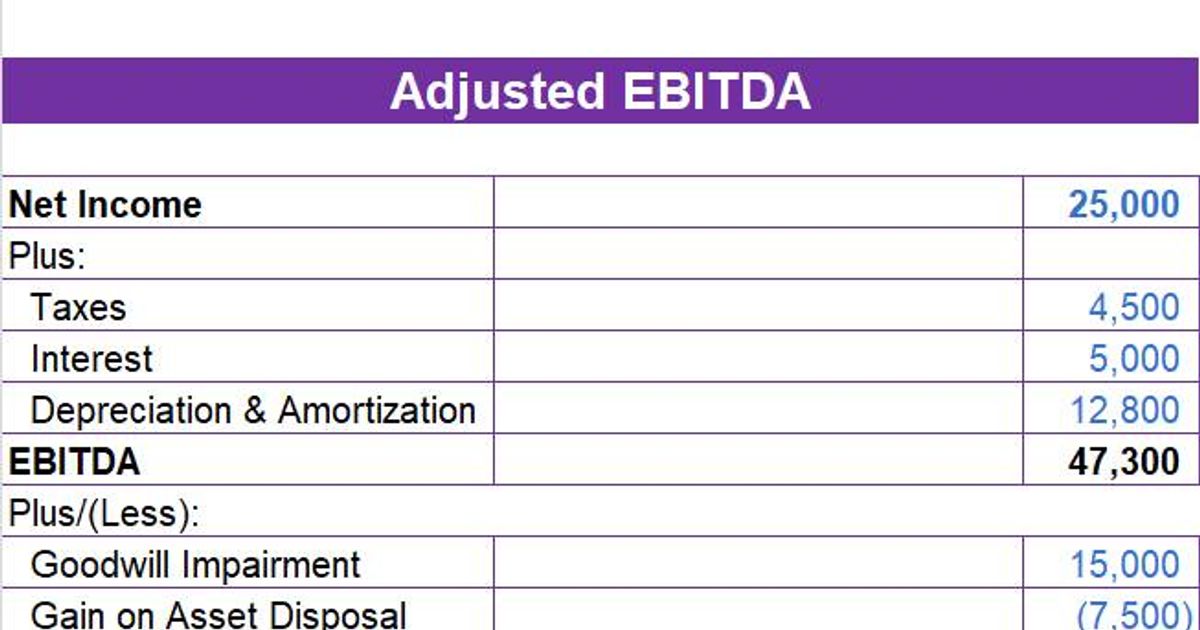

Adjusted EBITDA Template & Adjusted Statement Example for Excel

Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is short for earnings before interest taxes and depreciation. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is useful to assess the underlying profitability of.

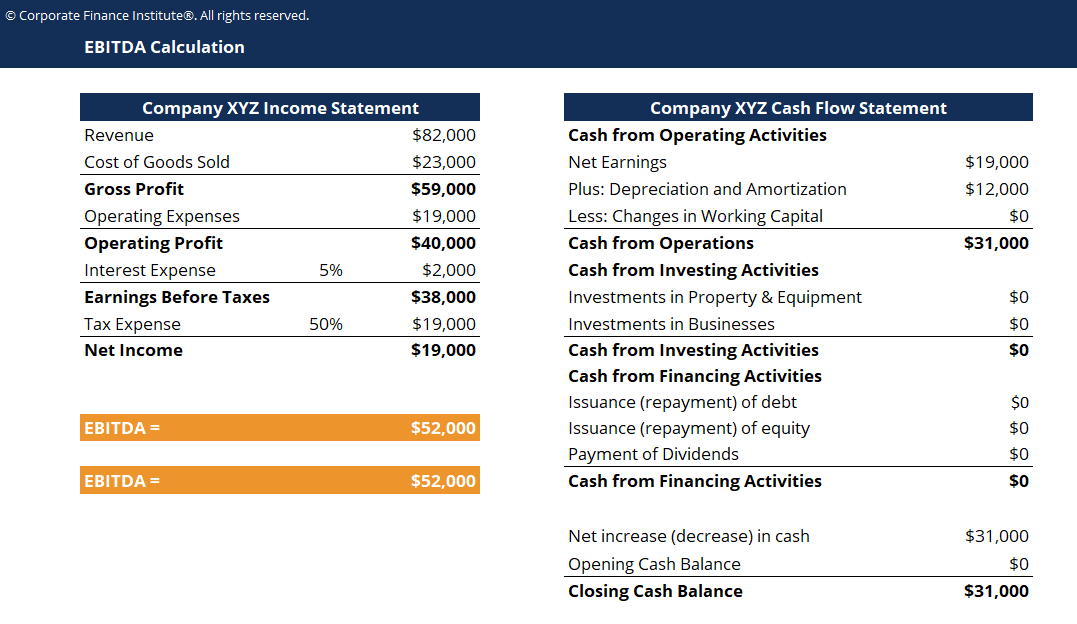

EBITDA Template Download Free Excel Template

Ebitda is widely used when assessing the performance of a company. Ebitda is useful to assess the underlying profitability of the operating. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is short for earnings before interest taxes.

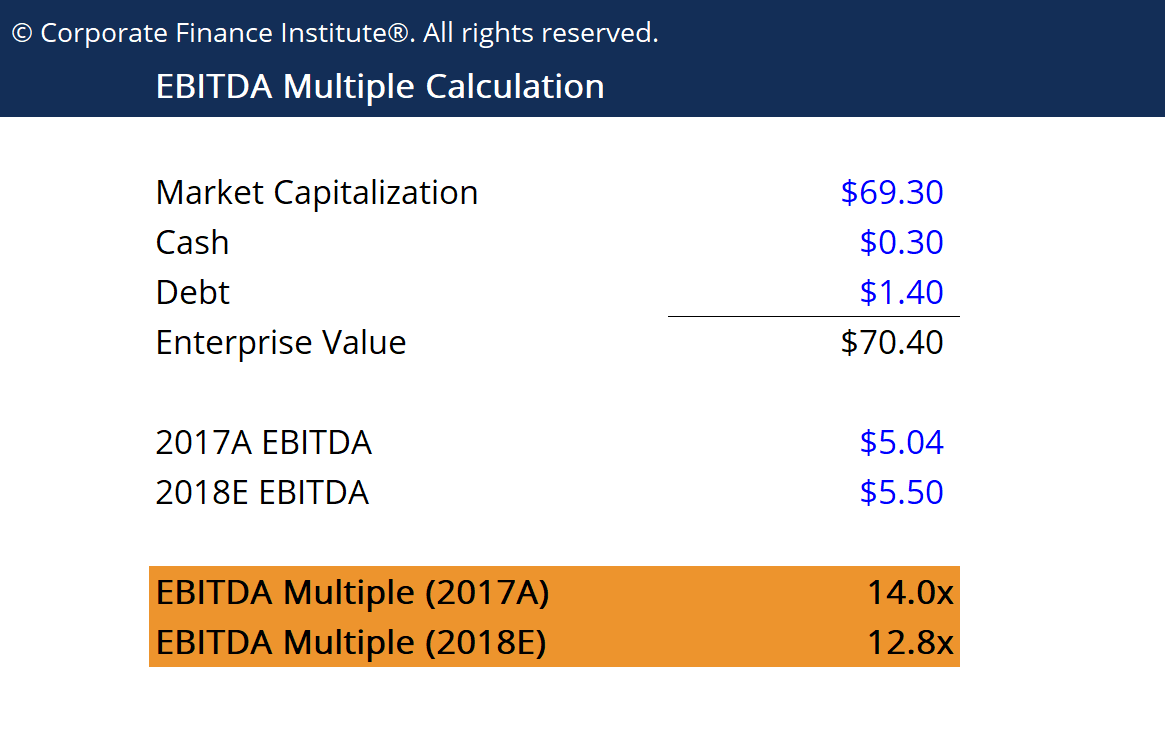

EBITDA Excel Template Easily Calculate Business Value with EV Model

Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is short for earnings before interest taxes and depreciation. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of.

Free EBITDA Excel Template Calculate Earnings Quickly and Easily

Ebitda is short for earnings before interest taxes and depreciation. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much.

EBITDA Multiple Template Download Free Excel Template

Ebitda is short for earnings before interest taxes and depreciation. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is widely used when assessing the performance of a company. Ebitda is useful to assess the underlying profitability of the operating. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of.

Ebitda Excel Template prntbl.concejomunicipaldechinu.gov.co

Ebitda is short for earnings before interest taxes and depreciation. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is useful to assess the underlying profitability of.

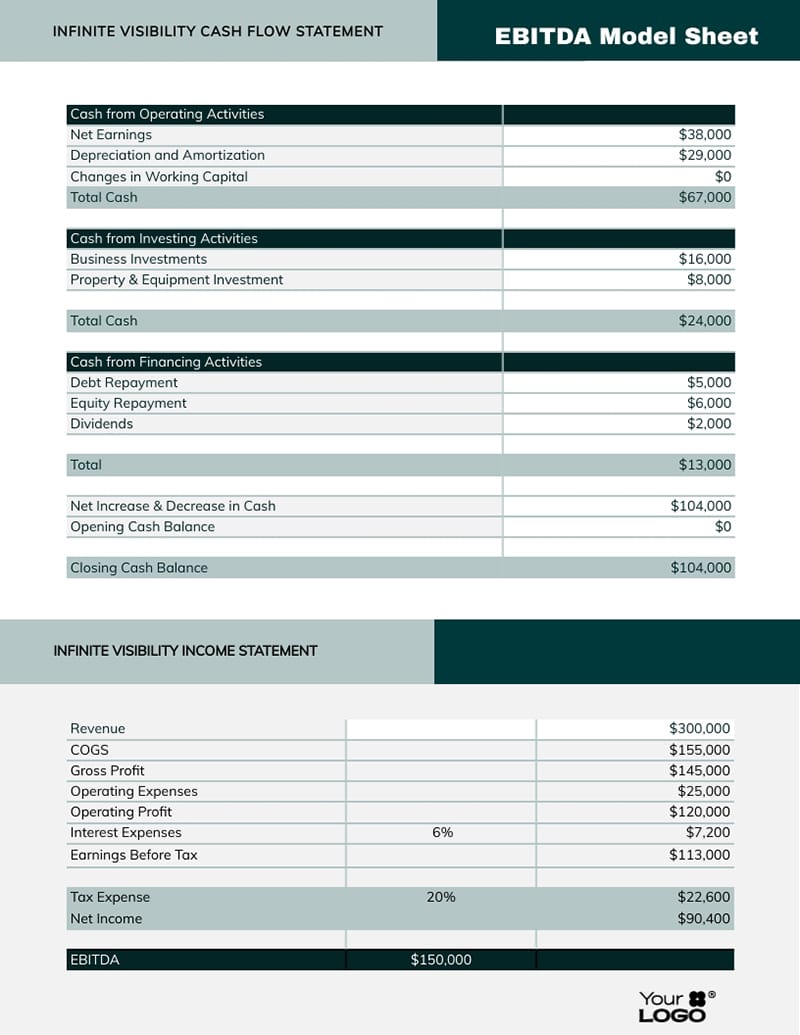

EBITDA模型表模板 Visme

Ebitda is short for earnings before interest taxes and depreciation. Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of.

Ebitda Excel Template prntbl.concejomunicipaldechinu.gov.co

Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is short for earnings before interest taxes.

EBITDA Template PDF

Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is useful to assess the underlying profitability of the operating. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Ebitda is widely used when assessing the performance of a company. Ebitda is short for earnings before interest taxes.

Free Adjusted EBITDA Excel Template Quickly Calculate Profits

Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of a company. Ebitda is short for earnings before interest taxes and depreciation. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a. Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of.

Ebitda Is Short For Earnings Before Interest Taxes And Depreciation.

Earnings before interest, taxes, depreciation, and amortization (ebitda) is a measure of corporate profitability. Ebitda is useful to assess the underlying profitability of the operating. Ebitda is widely used when assessing the performance of a company. Ebitda, short for earnings before interest, taxes, depreciation, and amortization, tells you how much money a.